You Need Help: Balancing Financial Security and Moral Bankruptcy

Q:

At some point about two years ago I basically went to sleep as a 30 something married, heterosexual, stay-at-home mom with financial security and woke up an angsty, gay teenager in an anarchy t-shirt looking for a fight and some weed; ready to light everything on fire.

There was more to it, but you get the idea. Big shifts.

I’m rebuilding my life as a single gay mom while healing from trauma and just trying to make ends meet.

I want to be secure (financially and emotionally) for me and for my kids in a world I generally don’t agree with, want to rebel against, and feel like a total alien in. I do not want to give my time and labor to something I don’t feel connected to. I want to be passionate about the work I do and feel like it’s something positive for the world but I feel directionless.

Any gay advice you can give is super appreciated. xo

A:

An important starting point here is to acknowledge the things you’ve already done that stand in the face of the compromised world we live in. You had a life that many people would say was “secure,” and yet you confronted the ways in which that life wasn’t serving you, was even hurting you, and that you deserved so much more. You shouldn’t diminish the tremendous value of living life on your own terms because of the example you’re setting for all the people around you — most of all your kids.

I can understand why that might not feel like enough. I’m of the belief that there is, unfortunately, no way to live a life that isn’t complicit in the moral bankruptcy of the world. Examine any action and you’ll find that it supports something utterly heartbreaking. This is particularly true when it comes to securing our livelihoods. If you stay in an organization long enough, you’ll start to question how committed it is to its mission over its funders and whose lives are being sacrificed to make it all happen. Which is why I think it’s important to acknowledge what you’re already doing because there is no truly satisfactory answer to the question of “how do I live by my values in this fucked up world?”

That doesn’t mean you should give up, though. If you haven’t yet, define what financial security actually means for you. I mean concretely – as in, what are the numbers? If you’re not sure, start by tracking your expenses assiduously for three to four months. A number of online services can make this easier. Or if, like me, you’re wary of giving your financial information to third parties you can do it the old-fashioned way with a spreadsheet and your bank and credit card statements. (I make a note on my phone when I use cash.) This will be tedious and time consuming, but it’s worth it. With your spending data, you can quantify the income you need to cover basic living expenses and things you and your kids enjoy.

Be sure to factor in savings because they will increase your financial security and make risks feel more approachable. There are countless resources on how much you should be setting aside each month for emergencies and your and your kids’ futures; talking to a financial planner can also be helpful. This might feel daunting initially, but putting concrete monthly targets around your savings will allow you to work towards building sufficient savings and see how much flexibility you have with your income. Of course, savings are the literal fuel that the capitalist, white supremacist machine burns to keep running. I really don’t think there’s an alternative, though. Using a credit union can mitigate some of the damage, but the challenge is finding a convenient one. (I’m still waiting for Superbia to launch.)

Putting all this together, you can calculate the salary you need to live comfortably and save. That’s half the information you’ll need to explore your job options.

The harder part is managing that sense of feeling “directionless.” One approach is to work on making your current job more aligned with your values. A few ways to do this include: making sure under-represented groups (particularly Black and Latinx people, trans people, and people with disabilities) have a voice in important conversations, encouraging supervisors to examine their problematic assumptions, and pushing hiring and retention managers to follow practices that promote diversity and inclusion. This can be incredibly frustrating work, but it is critical and necessary in every organization.

But maybe it’s just time to do something new. If you’re struggling to decide on your next professional move, take stock of the things that you’ve done so far, whether or not it was in the context of a paid job, and reflect on what you liked and didn’t. You can also use this exercise to make a list of things you’ve always wanted to try. Talk to people you trust who can help you identify strengths you take for granted. Using those reflections, start looking at jobs that are more aligned with your values and interests. They might feel out of reach, but I promise you that is the gendered bullshit of the world whispering in your ear. My friends always tell me to do informational interviews with people in organizations I’m interested in because that can help you learn more about the field and build your network. I also hate talking to strangers, so I get that this isn’t for everyone.

You might find that the most fulfilling-sounding jobs are completely impractical: they pay too little and expect too much work on your own time. This is the sad reality of the capitalist nightmare we call life. In that case, look for jobs that aren’t exactly your dream job and are “only” somewhat morally questionable but meet your salary requirements and give you enough time outside of work to pursue the things you care about.

Don’t forget that money is the driving force of our world. Buying from ethical organizations owned and operated by people from under-represented groups may help you feel like more of your resources are going to things you believe in. This also has no real endpoint so pick what feels possible within the confines of your budget.

Finally, remember that doing “something positive for the world” is a constantly moving target. Everything I’ve suggested comes with some unfortunate tradeoff. You may find that one approach feels good for a while, but after a few years you’re ready to move on to something else. Be kind to yourself — recognize all the things you’re doing — as you continue fighting for a better world.

Gaby Dunn’s “Bad With Money” Will Make You Love Talking About Finance

If you’ve ever felt super duper freaking overwhelmed by money and like personal finance advice was not meant for people “like you,” whatever that means, you need to run and preorder Gaby Dunn’s Bad With Money: The Imperfect Art of Getting Your Financial Sh*t Together. Like, go. Now. I’ll wait.

This book would have saved me many, many hours of deep internet research when I was trying to teach myself about personal finance. The sixteen chapters cover everything you’d expect in a financial advice book from credit cards (Chapter 8: Imaginary Money) to student loan debt (Chapter 3: The Neck Tattoo of the Financial World) to dating and relationship spending (Chapter 11: My Love Don’t Cost a Thing) to retirement saving [Chapter 14: Plan (Michael B(ay)].

It also covers topics that you might not expect, but that are really, really important for all of us to know — like why financial advice gurus are maybe just selling you a capitalism-fueled crock of shit (Chapter 9: A Fad Diet for Your Wallet), the gritty reality of freelancing and side hustles (Chapter 5: #Freelancelyfe), how your family history impacts the narrative we all internalize about money (Chapter 1: Your Roots are Showing), and how mental health and stigma and spending intersect (Chapter 7: Bipolar II: The Sequel).

There’s so much more. What stands out to me even more than how many distinct and important topics are packed into 265 pages, though, is the lens through which Dunn writes. You may be familiar with Gaby Dunn from A-Camp (which gets a shout-out in the book along with a list of current and former Autostraddle staff) or from Gaby’s writing on Autostraddle or from Gaby’s many projects — including the BAD WITH MONEY podcast, which became one of the top 10 podcasts on iTunes within a week of its launch. Dunn’s writing has appeared everywhere from Playboy to The New York Times to Jezebel and many other places, has a gazillion followers on every platform and about a million other publishing and vlogging and podcasting and writing trophies in her glittery trophy cabinet.

What I appreciate about Dunn in everything she writes and creates and produces is how earnest and hilarious and smart and intersectional she is. She brings all of that to Bad With Money. It’s a book for everyone, but particularly Millenials and Gen Z, who are trying to make something out of the damn recession we inherited. It’s a book that’s for queer people, though it’s not branded specifically as a queer or feminist book.

The queer lens is threaded throughout the book, whether it’s Gaby’s casual references to her dating life as a queer feminist with a radical point of view or the way she makes sure to start from a place of unpacking the ways capitalism privileges white, straight, currently able people before moving into a chapter on savings and retirement. It’s the way she gently takes down the way that neoliberal middle-class narratives around money often stigmatize poor people instead of focusing on the real enemy: rich people who benefit most from capitalism.

It’s the way Dunn makes room for you to find your own truth, rather than offering up disingenuous “simple” advice. In many places, she allows for more than one possible truth, which is just the queerest way of approaching any situation. For example, she gives you the info you need on common budgeting theories and then admits she doesn’t really use any of them in a pure sense in her daily life.

Bad With Money is unabashedly queer because Dunn is unabashedly queer. It’s the first time I’ve encountered financial advice anywhere (except in articles I’ve written for Autostraddle) that really spoke to me on my level. It was for me and it wasn’t here for BS or shaming or victim-blaming.

In the first chapter of the book, Gaby tells the story of her first episode of the Bad With Money podcast, during which she asked patrons (and one barista) to answer two questions: First, what’s your favorite sex position? Everyone answered that question willingly. The second, how much money is in your bank account? People were uncomfortable. “That’s a very personal question,” they said. That’s the problem with money; we don’t talk about it. We all worry about it and we all pretend that we’re just fine when we’re actually very not fine. We try to deal with it alone and feel bad and ashamed if we need help and yikes, it’s a cycle I know too well.

It’s also a personal question in that, like, money is this really personal thing all tied up in systemic inequities and multiple interconnected identities. This is the book that will help you overcome your struggle with talking about or understanding personal finance. It is a mix of very practical educational information (like what is a Roth IRA v. traditional IRA) and very personal stories and hilarious anecdotes. It’s a fun book… about finance? Dunn isn’t here to judge you. She’s here to help. Unlike popular finance websites and “gurus” who claim to have all the answers, Dunn is right there in the struggle with the rest of us. It’s not simple, she admits, and she’s still working on it herself.

Bad With Money: The Imperfect Art of Getting Your Financial Sh*t Together comes out on January 1, 2019 from Atria Books and you can preorder it right now! Seriously, you will love this book and then probably loan it to a queer friend who will also love it. I look forward to dismantling capitalism and also thriving in this crumbling economy with all of you!

Monday Roundtable: Hey Bad Spender

We’ve been talking about Bad Behavior for the past couple of weeks and this time we’re talking about how we’re bad with money. Our staff dishes on purchases that make them feel the worst, horrible spending habits, and all the ways the rent is too damn high.

What’s something you spend money on but you feel guilty about it because somebody of your income level should probably not spend money on this thing? Why do you do it?

Al(aina), Staff Writer

I feel guilty about literally all of my spending. I live alone, I have wifi and cable, I pay for Netflix and Hulu, I buy lunch more often than I should (there are TWO Chick-fil-a’s on my campus, what else am I supposed to do??). I make around $13K a year and take out around $35K in loans a year; I should be saving as much money as possible. But here’s the thing: I am happy-ish. I know that I feel safe in my home, I don’t have to sit in silence, and I’m eating during the day (when otherwise I wouldn’t). I spend my money in a way I know I shouldn’t because right now, that’s what I need. I don’t think I’d make it through grad school any other way, and when you’re broke, it’s harder to think about the future. I can be good enough right now, and honestly, that’s all I have the capacity to think about.

Alexis, Staff Writer

This is the best question because for once I can say EVERYTHING! I feel guilty about spending money for food, transportation, therapy, books, a nice night out, educational shit, apps, games, everything!!! And once I hit a manic phase: WATCH OUT! Off the top of my head, during those phases I’ve bought: a Wacom tablet, a POCKET C.H.I.P. (FROM CHINA), 10+ books, courses that I’m 900% sure I’ll take and will definitely change my life/move me into a better tax bracket but like don’t, binders that don’t fit, and comics and video games. Literally the only thing that doesn’t feel out of my league spending wise is donating/buying gifts for people I love. But don’t worry, feeling guilty is like one of my main character traits, so I definitely don’t feel like I’ll be stopping any time soon. I’m a real fun time y’all.

Heather Hogan, Senior Editor

I’ve always spent too much money on video games. When I was a freelance writer struggling to buy groceries and put gas in my car, I’d still happily drop $60 on whatever new open world RPG and just eat Hot Pockets for the next two weeks. HOT POCKETS. (I wrote that in all caps because of the TV jingle.) I’m more responsible about it now, but to this day I start itching if I walk past a GameStop. Video games have always been my main source of escape, from the time I got an Atari 2600 in 1984 until the time right now when I have a Nintendo Switch and I don’t have to think about Donald Trump being president when I’m smashing bokoblins and lizalfos. Super healthy!

Erin, Staff Writer

This is going to sound way more dire that it actually is, but food/drinks when I’m going out. When you’re at a bar with a DJ spinning a vinyl of like, the Beastie Boys or whatever, no one needs to be spending $18 for an okay glass of wine in that kind of environment. But sometimes you really do find yourself spending $18 for an okay glass of wine next to a man in a graphic tee while a DJ plays Beastie Boys on vinyl. I think I’m willing to do this (even though in every other area of my life I’m very quick to abstain from something if I don’t think it’s worth it) because I’m constantly aware that death awaits us all and I’m more inclined to want to heighten an experience if I can. Thank you for your time.

Yvonne Marquez, Senior Editor

I want to say food but I never feel guilty for spending $$$$ on a quality meal. I will gladly throw down $50 on an A+ meal complete with an appetizer, a main course and dessert. Food is my absolute favorite thing in the world and I love sharing it with people I love. I don’t mind spending my money on a delicious meal because I’m paying for an experience. My five senses are engaged and I’m investing time into relationships with my partner or friends or family. It’s beautiful. But I know very well I should be eating beans at home. I get bummed out when the food is subpar and then that’s the only time I regret my purchase and wish I could take it back!

Another thing I spend an outrageous amount of money is my hair! My hair cut and balayage is expensive af but I want my hair to look good. It’s like $225 plus tip for a cut and redoing my balayage and girl, I shouldn’t be spending that type of money. But I do it anyways because I want to feel good and look good. I want to be a trendy queer and have good hair even though I only leave my house to go to Trader Joe’s and walk my dog. I rarely style it but when I do I take all the Instagram selfies, duh. Also I really like my hair stylist and the money goes straight to her and not the salon she works at and my reasoning behind paying her an insane amount is that I’m putting money back into my community. So there’s that!

Rachel, Managing Editor

The biggest ticket item, if we’re being totally honest, is rent — when I moved out of the home I shared with my ex last year I made the decision to find a one-bedroom and live alone, even though it’s definitely a stretch on my income. I had just missed living alone so much, and even though the responsible thing to do would have been to find a roommate, having a roommate as a 30-year-old divorcée sounded sad to me (no judgement! just, you know, feeling insecure about where my life is at) and living alone in a one-bedroom I love as a 30-year-old, drinking box wine in a houserobe, sounded great. And I was right; it is great! It’s just also kind of expensive (relatively, I do live in the Midwest).

As far as a pattern of behavior, I think the thing I have the worst self-restraint about is… buying treats and things for other people? I don’t really want to think about what kind of weird codependent mother hen impulse it comes from, but if I’m meeting a friend for drinks it is like almost physically impossible for me not to just cover the whole bill; if someone I love had a bad day I will absolutely use my last $20 to order them a pizza when I’m still five days out from getting paid. This sounds like humblebragging but I swear to god it is not! This is a really stupid impulse and probably comes from some really dumb places of like basing my entire self-worth on how much I can provide to and for other people! I am in debt!!!

Riese Bernard, Editor-in-Chief

Postmates. It takes only the slightest tip of a to-do list from manageable to slightly challenging or the smallest unexpected mid-day time-sucker for me to justify ordering in. I love cooking breakfast, lunch has never held much interest for me in general (I prefer a series of aimless snacks consumed between 12 noon and 7pm), but dinner… I deeply desire a good dinner, but… I do not want to make it.

[Sidenote: I accidentally didn’t skip two weeks of Blue Apron recently (I know I should just cancel the membership altogether, which I only got in the first place b/c my then-gf and I were gonna do Whole 30 and they had a Whole 30 situation, but I cannot bring myself to) and found I genuinely looked forward to making those dinners. So maybe it’s not cooking I dislike, it’s eating the uninspired meals I usually cook? Also, I recently mentioned that I was happy to discover Blue Apron meals work just as well for one person as they do for the advertised two people, and then Kristin was like “yeah, ’cause then you have one serving to save for the next day” and I was like “oh, no, I mean like, because I eat 1.75 servings myself and then save the leftover meat for Carol.” And I got a lot of blank stares so IDK maybe there’s something deeply wrong with me, like a tapeworm.]

Still, ordering dinner saves me time when I need it, which is most of the time — I work a lot, more than any one person should, and I like to hoard the hours I don’t work to spend with friends. Also there are so many delicious restaurants within a four-mile radius of my apartment and people I’d like to overtip to bring it to me!

[Sidenote #2: If I’m being 100% honest, I occasionally order Postmates for meals besides dinner. Listen, for two years I lived in a giant house in the country and there was only one place, a gas station pizza parlor, that was willing to deliver to me! So now I’m… honestly there’s no excuse…]

Kayla Kumari Upadhyaya, Staff Writer

Oh god I spend so much money on food. Look, I know food is a necessity in life and not something that you should feel guilty about paying for, but when I tell you I spend a lot of money on food… trust me… it’s a problem. In particular, since I live in New York, I spend a LOT of money on having food delivered to me. Fun Fact: It’s pretty easy to discern when I’m depressed based on my Postmates order history. But even when I’m not having food brought to me by kind strangers, I still spend a lot of money on food — whether I’m eating out or cooking elaborate meals. I know how to eat on the cheap when I really need to, but I’m irresponsible when it comes to my food budget more often than not.

Archie, Comic Artist

I’m an indulger, I LOVE to indulge myself. In like, anything really. I think it’s probably because I’m a Taurus? It’s definitely not because I’ve got the money, that’s for sure. Anyways, I’ve always indulged myself in a lot of ways with a lot of vices and I’ve always refused to feel guilty about it. Capitalism makes us think one thing is more worthy than another or that if you’re broke you should only spend money on the necessaries. And yah, obviously one needs to survive first, but we gotta live too! And usually that’s how I excuse my habit of eating out a lot and wanting to get “a drink” at the end of every shift. But probably the most frivolous way I spend money is on books. I will buy at least two *NEW* books a month. And I don’t even feel bad about it because I love supporting authors and supporting local bookstores but also damn, get a library card! When I was working as a server I used to joke about how THIS was my retirement plan, I’d get old and open a lil used bookstore out of my house where I sell niche fiction and non-fiction LGBTQ books and there wouldn’t even be one book by a cishet man in the house. I’ve also spent like HUNDREDS of dollars I didn’t really have (at the time) on old lesbian pulp fiction and I dunno. I have a feeling this retirement plan isn’t actually financially secure. They sure look real pretty on my shelf though.

Laneia, Executive Editor

I try to be VERY frugal and stick to this tight-ass budget, which usually only allows for one restaurant/take-out party each month, and matinees only when we have gift cards, and one or two new shirts for the kids. I put money back each week so we can make a major purchase in April 2019. Like, I’m dedicated to this budget and to being good at money. So I was struggling to think of something I’m buying that’s kind of out of my league; an unnecessary thing that only serves me. Whenever I do spend money on myself, I have such buyer’s remorse that it’s almost not worth it, so I try to avoid feeling that way!

At first I was going to say that I probably spend too much money on ingredients for cooking, because I love to cook and I especially love to cook new things that these weirdos haven’t eaten before and which call for ingredients I don’t yet own!! The first two weeks after payday, please do get entirely out of my way in this kitchen, because I have many, many new things to create! It’s gonna take hours and lots of money! Wheeee!

But then, friends, I went to my hairdresser last week and when it was time to pay, I thought ah yes, this is the thing. It started out being a transitional color/cut situation, on my way to an extremely close buzzcut in time for summer. Then A-Camp happened, and everyone was SO NICE and SO EXCITED about my hair! I’ve never received so many compliments in my LIFE. Lizz Rubin was even like, “You can’t ever go back. This is you.” So now I’m still getting my hair bleached and toned, and I really, truly don’t ever want to stop! It is me! It’s the most flattering haircut and color I’ve ever had. It makes me like my own reflection! But y’all, I can’t believe how much money I’ve spent to make my hair this color, and then to keep it this color. It’s INSANE. So that’s my thing: the blonde hair on top of my head. Long may she live, I hope.

Valerie Anne, Staff Writer

I just keep saying yes to DOING things. From things as small as dinner or as big as going to Minnesota (?!) for a one-show-only con. (And I mean, it’s a Wynonna Earp con! So I’m very excited! But I think maybe my FOMO shouldn’t be stronger than my will to be able to pay rent on time every month.) The idiots at Capital One gave me a second credit card and I’m just like “Oh yeah sure I can do that” because I have room on it without any thought about how or when I’ll pay it off. I don’t make nearly enough money to be traveling so much!! I think the thing is, I lived paycheck to paycheck for so long, there were times when I was paying that overdraft fee two or three times a month at least, weeks were it was ramen for lunch, ramen for dinner every night. So now that I am in a more stable place, I act like I’m rich, buying campfire-scented candles in the middle of summer, throwing money at a reusable straw kickstarter that isn’t even sending product until November, tipping waitstaff 30% or more even if they were just average at being a waiter, buying whatever t-shirt strikes my fancy on Redbubble because there’s money in my PayPal account and if it’s not in my Bank of America account yet it doesn’t count. According to Gaby Dunn’s podcast Bad With Money, I have “poor person thinking” and it’s all my parents’ fault. I’m not nearly as bad as I used to be — I actually have a spreadsheet now that helps me keep track of upcoming automatic student loan payments — but the closest thing to a savings account I have is the exact amount of money my roommate pays monthly in rent tucked away so if she abandons me on a whim like my last two roommates did, I can cover a month and not have to borrow money from my mother. And part of me thinks probably I should have a proper savings account but also part of me thinks the world is ending anyway so might as well have fun while it lasts. I have a feeling someday I’ll regret that my credit score is shit. But until then I’ll see you in Minnesota. And Toronto. And maybe LA.

Alyssa Andrews, Comic Artist

I’m not into *things*. I don’t really online shop, or drop hundreds of dollars going out all the time. I’m pretty frugal with my cash. However! my monthly coffee budget… is in the triple digits. Like, higher than my grocery budget. It’s disgusting. And it’s not just the drinking of the coffee, it’s the ritual of *buying* it. I find excuses to get out of the house and buy that delicious cup of what-will-inevitably-give-me-the-shakes (almost) every. single. day.

I couldn’t tell you what it is exactly that makes me do it, but honestly — if I had to really process it with myself, it’s just a small luxury that I feel like I earn. I work constantly. Like, seven days a week I am hustling to track down jobs and drawing until my hands are sometimes literally cracking and bleeding — and I’m still (like everyone else) barely scraping by in getting my bills paid and feeding myself. It’s one of those little treats that I do for myself and fund little by little every day under the guise that I just deserve to have some of my hard earned cash go directly into making my days feel a bit nicer.

Also, TBH I’ve never really sat down thinking about just how much that five dollars a day adds up until… like now. So there’s that.

Cameron, Comic Artist

I don’t wear a whole lot of makeup, but I own a lot of it. It makes no sense. This is where my Sag Sun and Taurus Rising run wild. Every five or six months, I’ll go through a very short but hard-burning period of “What if I were the kind of person who wears make-up? What if I looked like I cared about my appearance? What if that’s who Future Cameron is?” Then I buy a very, very tame eyeshadow set & other tame items from Urban Decay, which is not celebrated for its tame looks.

“Why Urban Decay,” you might ask, “Aren’t they expensive?” Reader, yes, they are very expensive! But I used their stuff once and liked it and trying something else seems like a risk. The way the math works out for me is: I’m going to spend this money and I’m going to do it because I’ve decided that make-up will fix an unrelated problem that, in reality, requires work to fix. I won’t realize how ridiculous this entire charade is until I’ve gotten it out of my system.

I’ve gotten better about this lately, really. Or, I mean, I’ve branched out beyond makeup but I’ve ALSO reined in my impulse buys by (finally) regularly using a spreadsheet for budgeting. Now when I’m feeling like a superficial change will fix a persistent life-problem, I put things into an online shopping cart and stare at them for a while… Then I look at my spreadsheet and delete everything in the cart because I like not starving more than I like metallic eyeliner that I’ll never use. I really do wish I’d had this spreadsheet before I imprinted on a cologne last year though, because I’m 100% going to use it ’til I die. I’ll have no money to leave my loved ones but my corpse will smell amazing.

Carrie Wade, Staff Writer

I order food from elsewhere more often than I probably should. Breakfast and/or morning coffee are the main offenders. I’m somehow always rushed in the morning no matter how early I wake up; it’s gotten worse since I moved to the East Coast because my commute is more involved, but has kind of been a problem for the past few years (despite the fact that I’m a morning person by nature). So I often end up forgoing breakfast in my own home in favor of getting it on the way to work. I think it’s because I’m obsessed with being early/terrified of being late to anything (especially my job). If I feel like I’m skirting that line in the morning, breakfast and coffee will be the first to drop from the routine, because I always know I can get them on the other end. I work in a business district, so there’s no shortage of options, and thus the cycle continues. It’s so unnecessary, too, because I’m a good cook! But my sense of upstanding obligation kind of cancels that out in the mornings right now. I’m working on it.

Carmen, Staff Writer

My most honest answer to this is: ANYTIME I SPEND MONEY IS WHEN I FEEL GUILTY ABOUT SPENDING MONEY!!! Because we are all living in the dying embers of a capitalist hellfire and on some level being a millennial means being eternally being broke and having feelings about being broke. It’s a cycle. So, anyway! We have fun!

I probably feel most guilty when I spend money on makeup and fancy skincare products (I’m looking at you Glossier. WHY IS YOUR SUNSCREEN OVER TWENTY BUCKS for such a teeny amount? AND WHY DOES IT WORK SO GOOD?). We talked a bit about this in a previous roundtable; I loooove makeup! It’s my femme armor. It helps me feel strong and capable. If my face is painted, then the world isn’t seeing me at my most vulnerable; they are seeing who I am allowing them to see, and that makes all the difference.

The thing is, I also love expensive makeup. The fancy, good stuff that fills up shiny Sephora shelves and come in brand names like MAC, or Fenty, or Stila or (gasp!) Dior. Did you know that one tube of Dior mascara costs $30? Dear reader I will keep it real with you, I do not have $30 to spend on a tube of Mascara when Maybeline makes one for seven. You know it, and I know it. So, I try to break the habit. I try to tell myself that L’Oreal lip stains are just as good as NARS. Sometimes if I squint just enough, I even convince myself it’s true. But then Urban Decay will release a new Naked eye palate or whatever, and I’m starting back from square one all over again.

I shop sales and clearance. I buy “last season’s” hottest colors for the cost cut. I buy travel sizes or samples instead of the full bottle. I squeeze my Sephora insider points until they cry for mercy. I cut corners. Mostly that helps me get by. Still, I wince every fucking time.

Stef Schwartz, Vapid Fluff Editor

If I’m being real, I feel terrible about everything I spend money on ever, whether it’s taking a cab when I could just as easily wait 20 minutes for the train or ordering a spring roll with dinner. I’ve been trying to save up for a new laptop for about a year, but every time I come into some cash, I seem to blow through it immediately. I generally either have money saved up and no time to do anything with it, or tons of time and no cash to play with; as a result, I buy myself presents I do not need because I believe I deserve them. I think I buy myself presents to make myself feel better about working so goddamn much, sacrificing time I might have for a fulfilling personal life. Today it was plane tickets, tomorrow it may be kitchenware, and after that it will probably be guitar pedals. Someone help.

You Need Help: Your Girlfriend Makes More Money Than You, Just Wants to Have Fun

Welcome to You Need Help! Where you’ve got a problem and yo, we solve it. Or we at least try.

Q:

My partner and I have been together for five years and are engaged, I love her very much and we have a genuinely great relationship. The one thing that distresses me is money. My partner is earning more money than me and has always been better at saving and managing finances. She likes to spend this money on holidays, nice food, and memorable experiences. I can rarely afford to keep up with this lifestyle without accumulating credit card debt and have no savings to fall back on.

This has always been a pattern in our relationship and I have brought it up numerous times as problematic, not because I don’t want her to spend her money on nice things, but because when I say that I can’t afford to go on holiday with her or book a fancy hotel for her birthday, she always frames this as me not wanting to be romantic or adventurous. This is despite me wanting to save money for things like a house, where some delayed gratification is necessary, and despite the fact that she even wants a house more than me!

Recently she has moved to a different city for work and while we plan to live together again in the next few months, managing the rent on my own has made finances even tighter, while I’m also expected to travel to see her regularly. When I can’t afford to travel to visit her, she gets upset about missing me and questions whether I want to see her if I’m being reluctant to book travel.

Obviously this is frustrating, especially when I’ve asked her not to make me feel guilty for wanting to not get into (more) debt and trying to save money for our future together. She does get it when I bring it up and apologises, but her solution is then to spend the money herself on a fancy hotel room for her birthday, my travel, and so on, which makes me feel guilty about not being able to do nice things for her. I’m not particularly romantic either, so find it hard to figure out how to make it up to her with smaller gestures.

I don’t know what to do to make her see things from my point of view because it’s justifiable that she wants to make the most out of life while she can. She thrives on new experiences and it boosts her mental health to have these things. She’s said on more than one occasion that not going on holiday for a year would exacerbate her depression, which also makes me feel like refusing to spend money is contributing to her poor mental health. It also makes her sad to go away by herself though, as she would much rather be making those nice memories with me around.

How can I support the way she wants to live and not drown in debt?

A:

Friend,

I am so glad you wrote in to ask this! Firstly because money issues and sex issues are the main issues all couples face, and I want to reassure you that you’re not alone in having these worries and frustrations. Secondly because I make less money than my partner so I have a little bit of experience I can share with you. And thirdly because the way you wrote about this conundrum is so level-headed and full of a real sense of urgency to make sure both you and your partner have what you need and want for your mental health. That’s a great leaping-off point for addressing any relationship riddle and I feel confident y’all can come to a better understanding around money that will make both of you less stressed out.

Let me pull out the two things that jumped out most to me from your question. Neither of them are really about money.

When you say you can’t afford something, your fiancée frames it as you not wanting to be adventurous or romantic; or when you say you can’t afford to come visit her, she frames that as you not wanting to see her. That’s a thing that’s going to need some work, and I think it would be best if that work came proactively. By which I mean: Don’t wait until the next time she asks you to do something that’s out of your financial comfort zone to talk about this. It feels very necessary for you to say to your fiancée, “Hey, babe! I think there’s a better way for us to talk about money, and I would love it if we could find a good safe time to sit down and really hear each other about our financial realities and goals so we can make sure we’re supporting each other’s individual needs and empowering ourselves to have the best future possible!” (If you initiate that conversation over email, I would advise not making the subject a smiley face. My research suggests that comes off as sarcastic.) (Just a little side tip, you’re welcome!)

Of course, when you’re having a tough conversation it’s best to use “I feel” statements and avoid saying things like “always” and “never.” Just for one example, “You always make me feel like a broke bitch.” That is not a good way to say the thing you want to say. “I want you to have everything you need to be happy and mentally healthy, and I want to contribute to that happiness and mental healthiness, but sometimes when I tell you I can’t afford to do the things you want to do, I feel like you don’t hear the real reason, which is that it will cause me to go deeper in debt and that stresses me out and makes me feel like future me isn’t going to be in a good position to give us both the big things we want, like a house!” That is a good way to say the thing you want to say.

The other thing that jumped out at me is that you feel guilty when your girlfriend offers to pay for both of you to do the fun things she wants you to do. That’s some work you’re going to have to do internally, and oh, I understand how hard that is. Why does it make you feel guilty? Is it the way she offers? Because if so, that’s something to bring up in the conversation I mentioned above. If not, though, really: why do you feel that way? Is it because you grew up in a supremely patriarchal religious institution where you were expected to stay at home and have babies while your husband provided for you, and thinking about anyone “taking care of you” financially taps into that trauma? Is it because you’re afraid to rely on her financially because what if she leaves and you’ve lost the ability to take care of yourself? Is it because you’re afraid that she’ll grow to resent you for not being able to pay for half of everything? Is it because you believe you’ll be indebted to her in ways that aren’t financial if she pays more for things than you do? That it will shift the balance of power in your relationship? That it will mean you’re expected to do more housework because of internalized ideas you have about gender roles and money? That it will cause you to lose any sense of personal control over your life?

I’m just tossing out all the reasons I struggled for years to just accept the fact that my partner makes more money than me and that it’s totally okay. In fact, it’s very normal for one person in a couple to make more money than the other person!

Once you unpack why you feel guilty, talk to your fiancée about it. It’ll probably help her to understand more of where you’re coming from, and allow her to ease some of your anxieties, and permit you to begin working to let go of the guilt so you can just go to a nice hotel for her birthday and enjoy it!

On a practical, actual money level, it’d be good for y’all to sit down and talk numbers. How much money do you each make, what do your individual monthly budgets look like, how much money do you both want to be saving for your house, and then how much disposable income do you both have left, at the end of the day? If you have a hundred dollars left and she has a thousand dollars left, maybe you agree to pay ten percent for fun things and she pays 90 percent. It’s proportional! And fair! You each have the money you have and you’re a team and when you combine that funtime money together — no matter who put in how much — you get to spend it as a team!

I’ll leave you with Mr. Rogers: “Love isn’t a state of perfect caring. It is an active noun like ‘struggle.’ To love someone is to strive to accept that person exactly the way he or she is, right here and now.” Be honest and compassionate with each other about who and where you are at this moment in time on your long and winding and ever-evolving relationship path; you’re gonna be great!

Yours most humbly,

Heather

LGBT Credit Union Superbia Wants to Help You Keep Our Gay Money in the Family

“What does gay money look like? Not surprisingly, it looks a lot like money. Gay money happens to be the same as non-gay money. So why can financial institutions in America still be allowed to discriminate on the basis of sexual orientation and gender identity?”

So asks the welcome video that explains Superbia, the first explicitly gay credit union. I’ve been waffling on dumping my money out of a large corporate bank and into a credit union for a long time; credit unions exist to serve their members and are, in fact, owned by said members, so profits from it go right back to those with accounts at the institution. Credit unions are by and large not funding things like the Dakota Access Pipeline. They keep money local and decentralized. In short, credit unions are bomb. But my problem is that I haven’t found one I’m in love with yet.

My face went totally heart-eyes-emoji when I got the press release about Superbia. Explicitly for the queers and our allies, this sucker will not only function like a normal credit union would, but it will also pour 30% of its profits back into community organizations. And they’ll do this by making sure you aren’t refused service at your goddamn financial institution, a thing that still happens despite the fact that it is 2018. The promotional material cites a bunch of studies proving that queers undergo financial discrimination, but I know I don’t have to explain that here. Because we’ve all felt it. We’re all keenly aware of the subtle-yet-pervasive sense of economic dread, and some of us may have experienced outright hostility when applying for loans, for instance, or trying to open a business.

Founder Myles Meyers (epic name!) is keenly aware that our financial needs as a community are unique. From the press release:

In the same way a bakery can refuse a cake, one bank’s discrimination could lead to higher interest rates on homes, rejection of student loans, judgement on credit for health needs, outdated products and services for LGBTQ individuals and families, and lack of acceptance and understanding among traditional institutions. Twenty-nine states currently have no anti-discrimination laws in place, meaning sexual orientation or gender identity may be considered in accessing credit. “Our families, lives and financial journeys are not necessarily the same as those of other communities,” shares Meyers. “The products we need and how we are communicated to should reflect our community, using our values, as we determine.”

The credit union’s tech will be powered by CU*Answers and the credit and debit cards will be Mastercards. They’ve got it all planned out and they’re ready and raring to go. Their next step is raising funds to set up the credit union, which they’re doing on Indiegogo. Now I normally do not, under any circumstances, write about a fundraiser. But truly, honestly, my need for you all to know this exists comes from one place deep in my very soul: the place that wants to give my money to my fellow queers. I make a lot of decisions with my money to keep it in the fam. I love to pay queers. Love love love it. And essentially that is what being a member of the gay credit union would be: paying queers. Members vote on what organizations get our money as members; and if members need a service that isn’t being provided, they ask for it and are actually taken seriously. Superbia is already partnered with Stonewall Community Foundation to administer grants to LGBTQ organizations. If all goes well, this will be up and running by Fall 2018.

Decentralizing money and orienting it toward community is one decision that individuals can actually make that disrupts some of the unfettered power that large corporations have in this crazy, crazy world of our own making. In summary, here are the bare bones bullet points of what this financial institution will be all about. From their Indiegogo page:

We will

- Remove the risk of discrimination that members of the LGBTQ community can still encounter at traditional institutions

- Provide unfettered access to tailored financial products and services

- Harness the power of our diverse and activated community to provide equal economic opportunity and support to our community.

Superbia will serve its members in three important ways

- Provide fair, non-discriminatory and unique products, services and treatment that honors the unique needs of the LGBTQ community.

- Put profits back into Superbia to offer better saving and lending rates, and other improved services to our members

- Awarding up to 30% of remaining annual profit to directly fund LGBTQ organizations, causes and community needs.

If this sounds good to you, consider heading over to Indiegogo (where, if you’ll recall, we raised funds for our massive redesign back in 2012, so yay Indiegogo!) and consider making a contribution to the founding of Superbia. And since it’ll be Mastercards, I’ll close with the following:

Minimum contribution? $50

Special Founder’s Edition Mastercard? $250

Having a bank that helps sustain the community and gets your pronouns right? Priceless.

Home Sweet Homo: An Autostraddle Homeowner Roundtable

A few weeks ago, I walked you through buying your first home and now I asked some folks ’round here who’ve gone through the home buying process to share their experiences and wisdom with y’all! Here’s what they had to say!

Cee Webster, Tech Director & American Gothic Gardner, Portland, OR

Cee’s 100-year-old house is super souped up with futuristic tech, as written for the Daily Dot by Taylor!

Beth Maiden, Writer & Boat / Tiny House Dweller, Isle of Skye, Scotland

Beth’s various homes, which you can read all about on Narrowboat Swallow. Beth was referencing her experience buying and living on Swallow (bottom right and left) when she answered these questions.

Update from Beth: I lived on my boat until 2015, when my partner and I both sold up, repaid our parents, and moved ashore. We were ready for a new chapter and very open to wherever the wind may take us. We came to the Scottish Highlands and WWOOFed (land-based volunteering) in exchange for caravan accommodation, then lodged in friends’ spare rooms, even living in a holiday home for a few months. Eventually, we got sick of housing insecurity and living out of boxes and decided we were ready to buy a house. This huge step was only possible for us because we had lived so cheaply for previous years, so we had been able to save up for a deposit (down payment). The overwhelming paperwork described below has been very real for us: we’re both self-employed and have lived off-the-radar for years, we got turned down for two mortgages before finally finding a small building society who treated us like human beings. We move into our very own house next week, and I’m beyond excited about it! It’s been a journey of roughing it and compromise, but it’s been an adventure. I’m looking forward to the next chapter, hopefully one of housing security and relative ease. But all that said, I would recommend #BoatLife to anyone who doesn’t mind giving up some home comforts in exchange for adventure and cheap living!

Aja Aguirre, Former Fashion Editor & Founder of Fit For a Femme, Oakland, CA (formerly Boston, MA)

Aja in her new home (which she and her wife bought after selling the house she was living in when she answered these questions!) via Fit for a Femme

KaeLyn Rich, Staff Writer, Rochester, NY

Why did you decide to buy your first house? What factored into your decision to start looking?

Cee: I’ve always wanted to own, but never lived anywhere I could realistically afford to. I moved to Portland with buying a home in mind, and spent about a year learning the market, the neighborhoods, and continuing to save for a down payment before I started officially house hunting.

Aja: We were looking at a few time-sensitive motivating factors — where we wanted our daughter to attend high school and where in the country we could afford to buy in an excellent school district that was also in a state where our marriage would be legally recognized. In 2012, pickings were rather slim and we were right at the precipice of a radical housing shift in the Bay Area.

With her headed to college in the fall, we just wanna go home, downsize significantly and have merciful commutes; all these things will help immensely with quality of life!

Beth: I knew that when I moved out of my ace little rented flat, it would be to do something different, to move beyond renting and into something I owned. I got together with my current partner, who lived on a boat, and discussions about moving in together turned into ‘how about we don’t move in, and instead I get my own boat?’ I got really excited and started looking!

KaeLyn: We never planned to stay in Rochester when I moved here for a job promotion. We also were a hot mess in our early twenties. But by 2012, we had worked out our shit, gotten legally queer wed, and had put down roots in the city. We started casually looking, mostly online and by attending a couple open houses, for about two years. We kept waiting for the perfect moment financially to start looking “seriously,” but life is complex and that moment never came. Ultimately, we decided we were as ready as we were going to be and we contacted a real estate agent.

What kind of things did you do to prepare for buying your first home?

Cee: I saved for years and made sure my credit was good first. Then I learned the market, what houses were worth, I toured several dozen homes and obsessively checked Redfin. I went to a few house buying classes and asked a million questions to my real estate agent, who was very patient with me. He became a friend of mine, and took me to “estate agent only” pre-viewings and on tours of houses for his other clients, so I could learn the industry a little. It was really fun for me to be honest, I love looking at houses. I also found a very good mortgage broker who helped me get a mortgage after the local credit unions and banks turned me down (self-employment = unemployment in their eyes apparently).

Beth: Not a lot. I found my dream boat on eBay for £6500. I had to make the case to my parents to lend me the money to buy it as I had no money at all. They’re used to my weird schemes but this was the only time I’d ever asked for money and they took some convincing that this was a good idea.

Aja: This could be its own post! We had a very complex, multi-faceted problem to solve using research and loads of data: school district scores, real estate markets, job markets, local and state laws and taxes, finding an agent (who found us a broker and a lawyer and, incidentally, our current agent out in Oakland — they’re both absolute gems) and learning the sometimes baffling differences between MA vs CA real estate, planning travel and timing around the school calendar, and then again around the new school calendar and school district entry requirements. We ordered a giant white board called Big Bertha and mounted it in our living room with charts and a map of the country, cross-referenced with shared Google Sheets and our bible, Nolo’s Essential Guide to Buying Your First Home, which I highly recommend!

This time around it’s just reversed, and significantly less stressful on the education-related front. However, the Bay Area real estate market is so ruthlessly competitive that offers with contingencies (which used to be somewhat routine) go straight into the recycling bin, so we’re having to strategize around timing in several areas, like planning short-term housing given the number of variables outside of our control. As big a PITA that’ll be, it’s nothing compared to making a long-term six-figure mistake on the wrong house!

KaeLyn: We both have decent credit scores, which is something I worked really hard to achieve after a little tough spot immediately after college. We made a list of all the things we wanted, the must-haves and the would-be-neats and the no-ways. We knew what neighborhoods we wanted to look in, so we contacted an agent that was recommended through a friend and who does a lot of work specifically with LGBT buyers and in the neighborhoods we were considering. He came up with some suggestions. We already had a good idea of what we wanted in a house, so we also looked for interesting properties and sent them to him. We actually found our house by scouring online listings on our own. We were one of the first to see it (due to me putting some pressure on my agent to expedite the appointment) and the very first to put an offer in, which was fortunate because another couple put an offer in later on the same day, the day after it was listed.

What was on your must-have list when you were searching for your home?

Cee: I was very particular about which neighborhood, and I wanted an old house that wasn’t remodeled modern. I was willing to rip out carpets, change fixtures, appliances, etc, but I wanted the old charm underneath. I also wanted a decent yard. And to be affordable, either a few bedrooms so I could have roommates, or a finished basement or in-law apartment I could rent.

Beth: It had to be super cute, super cheap, really small (I was scared of steering a huge boat), and near enough that I could move it to the town where I lived.

Aja: Hm, let me fetch our ridiculous list. Here it is:

Commute

Surround Sound*

Pre-wired Ethernet*

Closet Space

Master Bath

Light

Positioning/Views

If my wife never hears me say, “It’s a perfect house, but I can’t stand the way it’s situated,” again, she’ll be thrilled. On the other hand, she’ll point out a fig tree in the backyard and say, “This is the most perfect house in all of Oakland,” even if the kitchen needs to be completely torn out and the interior has all the natural light of a bat cave and it’s over budget. We should have our own obnoxious HGTV show!

In all seriousness, though, we both know there are hardcore must-haves (why do so many New England houses not have en suite master baths?!) and negotiable nice-to-haves, and that we’ll each likely need to make trade-offs when push comes to shove, especially if we want to live in SF or Oakland. C’est la vie!

*These are her “gaming-specific needs”. FYI. Preposterous!

KaeLyn: We wanted off-street parking because we live in a city were driving is the most efficient mode of transportation and we work opposite shifts and need a reliable place for our two cars. We’d messed around with on-street parking before and hated it. We wanted three bedrooms, two toilets, and we didn’t want to have to do a lot to the house to move in. Neither of us are particularly handy. A big bonus would be a sunroom, like our most favoritest favorite Rochester apartment had. We didn’t get that, but our house does have a sleeping porch we never use that we absolutely fell in love with.

What was the hardest/most confusing/challenging part of the home-buying process?

Cee: The market in Portland is nuts at the moment. My house was the 9th house I put in an offer on, being outbid by full cash offers over asking each time. Other than that I really enjoyed learning the process.

Beth: Being new to boats, it was hard to know what questions to ask the owner. Also, it’s wise to have a hull survey when buying a boat — this is where the boat is taken out of water and an expert checks to see that the hull (the bit in the water) is sound and not about to wear through. It’s expensive and a big risk — what if you find out that the boat needs replating or is about to leak?

Aja: Nobody warns you how emotionally exhausting it can be. I’m very resilient, a tough cookie, and yet there I was, crying on a rental car shuttle en route to Logan. I think we were in the security check line when our agent called and said our offer had been accepted and we had to spring into action. I waved my wife and child goodbye after we rebooked my flight so that I could stay behind for inspections and to sign miles of paperwork, while they headed back home (where our dogs were waiting with the petsitter) and to work and school the next day. That was only the beginning; we had offers accepted on two different houses and walked away from both (and thousands of dollars) because of poor inspection results. After subsequent and increasingly frantic SFO-BOS house hunting trips, the third time was the charm — but it also meant that the first time I laid eyes on this house was when my wife carried me laughing over the threshold, after we’d already bought it!

KaeLyn: It feels so intense when you put an offer in. You start to imagine your whole life in the house, with your stuff in there and the things you would do to change the place and your future self all wrapped up in it. The feeling that you could lose it if the offer isn’t accepted or if the closing doesn’t happen on time is super stressful. We got the sense the seller felt like they accepted our offer too quickly because there were other offers right after they accepted ours and they kept the listing up online with a higher price and new videos after we were in escrow. I was so nervous we wouldn’t meet the closing date, especially when the bank flagged a couple bank account deposits from my part-time contract job that I initially forgot to report. It all worked out in the end and the forest-worth of paper to sign on closing day felt like a relief.

The other thing that was complicated were my feelings about buying a flipped house. I know that queer neighborhoods tend to converge with hipster/trending neighborhoods that are initially diverse until our occupancy drives up the values and pushes poor people out. I love our house and that we didn’t need to fix anything because we suck at that and we also couldn’t afford it at the time. I also felt confused about whether it was OK to move into a neighborhood that was just outside the trendiest “gayborhood” if our very presence was going to contribute to gentrification. I still feel weird about all this, especially as an Asian-American woman, for about a million different reasons. And our home value has indeed gone up rapidly over the past five years, for better or worse.

What is the best thing about being a homeowner vs. a renter (or squatter)?

Cee: I feel like I’m in control of my housing, which really reduces my stress. It took a hell of a lot of work but it was very worth it in the end. I also like that I can change stuff like appliances or fixtures and not have to wait forever for the landlord to do it (or more realistically not ever do it). It’s pretty rad. And I’m learning so much about fixing houses; I knew nothing before I moved in.

Beth: Like Cee says, it’s a sense of control. I would happily rent again, but I loved knowing that Swallow was mine.

Aja: Sweet, sweet equity. That aside, I do think it’s healthiest to view homeownership vs. renting as trading one set of advantages and disadvantages for another. I appreciate and see the value in permanency, I even like the romanticism of it. But I think folks forget that it’s almost mythological without being honest about the work and resources it takes to sustain it.

With certainty comes vast responsibility and that certainty is in no way even a little bit guaranteed — natural disaster, financial ruin, change in work (or school) and family status, like switching careers, divorce or having children, all can render the permanent soluble — so I just want to remind folks on the fence or who aren’t yet able to take on homeownership that it isn’t some end-all, be-all marker of adulting or personal success. For many, it doesn’t make sense on paper, and that’s okay. If the potential upside doesn’t outweigh the risk, it’s probably best to hold off and instead be well prepared for when it does!

It’s also critical to understand that for people of color and queer people of color, there’s a very complicated and appalling legacy of lending discrimination in this country that goes back decades and went unchecked until 1975, when the Home Mortgage Disclosure Act was passed. Mortgage discrimination is still a very serious issue with incomprehensible repercussions throughout public education and economic status for POCs and continues to feed on and perpetuate a system of racial bias today. I highly recommend reading the article Choosing a School for My Daughter in a Segregated City to learn more about that history and how it continues to disadvantage communities of color.

KaeLyn: Commitment is not natural to me, nor is staying in one place. However, putting down roots in a home that I own feels like making a commitment to the life side of my work-life balance. I don’t feel like I have to stay here forever, but I definitely could and I’m really happy that I feel so at peace about that. It’s a big thing for me. Especially now that there’s a baby in our house, it feels like we could live here a long time. I imagine her making friends with the kids across the street, playing in the backyard that I’ll eventually get around to dealing with, moving upstairs to the attic we might finish one day when she’s a moody teenager. I like knowing that this is ours as our equity slowly builds, though I occasionally miss being able to call someone else to deal with it (and pay for) when the heat stops working or the pipes back up.

What is your favorite thing about your current house?

Cee: My back yard is quickly becoming my favorite part of my house. I have a little grill and a hammock and I’ve planted all my favorite flowers back there and it’s very comfortable.

Aja: Superficially, that it’s a pristine three-story Victorian built in 1882 in a fantastic neighborhood within walking distance of shops, cafes, restaurants, public transportation, and a ton of green space and trails along the Charles River. We couldn’t remotely afford a tiny flat in one of these puppies back in SF, let alone an entire one all to ourselves! We were lucky to have found it.

My favorite thing about this house, though, is that it held us safe and sound these past four years. Through marriage equality milestones, with the Boston Marathon manhunt happening a mile away, for every holiday and birthday and anniversary together and through hurricanes and blizzards and the Worst Winter Ever, it’s been our sanctuary and our home base. As a mother, it’s the place I’ll think back to when I remember our last years with the kiddo living under one roof.

KaeLyn: I love the bay window with a roomy window seat in the living room and the other bay window directly above that acts as a sort of 180 degrees view scenic headboard for our bed.

What do you wish you’d known then (when you were buying your first house) that you know now (as a seasoned homeowner)?

Cee: You can change your house but you can’t change your neighbors or your neighborhood.

Beth: Don’t take the sellers’ word for anything. Do your own checks. It’s sad because I want to go through life trusting people, but that guy told me a lot of fibs about my boat and I had plenty of issues that I had to fix. Next time I’ll take it all with a big pinch of salt and have more realistic expectations about what I’m getting.

Aja: If your agent is any good whatsoever, they will briefly run your whole life. You will get emotional. It will be more expensive than you planned for. It will all be worth it!

KaeLyn: You will make an impossibly long list of all the things you’re going to do to renovate or change your home right after you move in. You will do very few of those things at all and spread out over a super long time. You will keep talking about those things as if you might actually do them one day just to give yourself hope that you’re not actually as lazy/busy as you are.

What advice would you give to someone who wants to buy a home for the first time?

Cee: Speak to a mortgage broker to learn what you can afford (it may differ than what you think) and if you qualify for a mortgage (you might, even if you don’t think so!). Once you know what you can afford, start learning the market and seeing what is out there. If Redfin is available in your city, set up an alert to send you push notifications or emails when houses are listed in your price range. Once you feel like you know the market a bit, find a good agent and start viewing houses. Good luck and don’t be discouraged!

Aja: There is no such thing as “too soon” when it comes to preparation. Don’t wait until you’re “ready” to talk to agents or brokers; bang out all the unknowns well in advance of actually starting the process. You can’t anticipate what you’re unaware of, learning the ropes months or even years ahead will give you the upper hand and a superior planning advantage.

Thoroughly know your budget inside and out before accepting a loan. Reverse-engineer your numbers based on a mortgage payment you can comfortably afford, not what the banks say you can afford. Get intel from homeowner friends in your area or from your agent on any new monthly expenses you may be unaware of as a renter — home insurance, local and state taxes, additional utilities, mortgage insurance (if applicable), include a savings bucket for the inevitable fixes that’ll pop up out of the blue at the worst possible time, etc. Nobody wants to be house-poor!

KaeLyn: Know yourself financially, but don’t set unrealistic expectations for yourself. The reality is you’re probably not going to save 20% down or pay off all your school loans/credit cards first, but it’s OK. If you can afford your payments and your bills are covered and your job is relatively stable and your credit score is decent, go ahead and see if the time is right for you!

Do you have any funny stories about buying your first home? Spill!

Beth: I have a whole blog full of stories about leaking windows, broken engines, falling in the canal and my tragic attempts at carpentry.

Aja: My wife has very few irrational fears, but bats are definitely #1. Within a month of moving in, she found something flying in relentless circles in the basement at dusk. “Jonesey, come look!” she said, “There’s a bird down here!” It was, of course, an actual, bona fide, possibly rabies-infested bat. WELCOME TO NEW ENGLAND!

KaeLyn: OMG, we had a bat, too! A couple dead ones in the attic and one live one in our damn bedroom. We think they must have come in when the folks who sold the house were working on it because we haven’t seen any since. We found the live bat when our cat woke us up one night. The cat was going utterly beserk on the bed, leaping around. We turned on the light and saw a scared and confused bat flying in circles around the ceiling fan. Waffle screamed and ran into the hallway. We had to coax the cat out because he really wanted to eat that bat. Waffle sent me back in and SHUT THE DOOR and kept screaming, “Get it out!” as he hid in the dark hall. I had to try to whack the bat with a broom, which I wasn’t feeling great about and couldn’t really bring myself to do because I love bats. I finally Googled it, with the bat swooping around my head, and realized the ceiling fan was throwing off its echolocation. Supposedly you can just open a window and they’ll use echolocation to find it and fly out. So I turned off the fan, which required me to reach up into the fly zone, opened a window from the top, and the bat fairly expediently showed himself out. I still can’t believe Waffle basically trapped me in the room with a bat. That’s love for ya’.

Oh and we had a running joke that we were so bad at home improvements that the only thing we did in the year was a home disimprovement. We turned one of the bedrooms into a free-range home for our bunnies (basically a luxe indoor rabbit lounge) and to be able to see them and let them see us, we removed the bedroom door and replaced it was an unfinished wood-framed screen door, like the $15 kind you can buy for your shed. I judge people on how visibly they judge us when they first encounter our indoor barn bedroom.

Do you have questions? Your own advice to future homeowners? Put it in the comments!

Home Sweet Homo: A Guide to Buying Your First Home

feature image via Shutterstock

There are a whole lotta benefits to renting, like not having to replace your refrigerator when it breaks or being able to pack up and move if your neighbors are awful. My partner and I rented for seven years in various roommate configurations, but after a while, when it was clear we were going to stay in the city we live in, we decided to stop throwing our money into a bottomless pit. We decided we’d like to own a little piece of Planet Earth to call our home.

We’re not alone! Since the 2015 SCOTUS ruling in Obergefell v. Hodges, federally recognized marriage equality means that married LGBT couples have access to the same protections that heterosexual couples enjoy when purchasing property together or raising children together. According to a recent survey of their 1500 members, the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP) found that 47% of their members believe more LGBT married couples are buying homes than prior to the federal marriage equality decision.

Marriage equality map over time from the L.A. Times chronology map

It can feel like a big thing, buying your first home. There’s a lot of money and planning and legal stuff involved and lots and lots and lots of paperwork.

Like most things in “grown-up” life, home-buying decisions for LGBTQIA people comes with unique considerations and challenges.

For example, depending on where you live and what your community is like, you may or may not be able to find an LGBTQ real estate agent. You may not even be able to find an openly LGBTQ-friendly real estate agent. Your agent may or may not know which neighborhoods are queer-friendly or may have misconceptions about what that even means and drop you into the affluent gay white neighborhood when you’d rather be in a different part of your city/town/county/whatever-kind-of-municipality-you’re-buying-in.

If you’re buying with a partner or partners, it’s imperative that your attorney knows what the laws are and what kinds of tenancy agreements are available to you that best protect your family. That’s on top of the stress of budgeting for, finding, getting approved to buy, putting an offer in on, and managing a timely closing on a home. Welp.

As a home-owning queer person, I’m here to help!

Deciding You’re Ready to Buy

via Shutterstock

What Is Your Life?

Before you commit to buying a home, you need to honestly assess where you are in your life. Buying a house is a huge commitment and it may or may not be a good fit for you right now.

- Do you feel certain you want to live in the same place for at least five years? If not, what would you do with your home if you decide to move in the near future? Are you open to renting it and being a landlord if you move? Could you sell it and recoup your costs quickly?

- Do you like the idea of being “tied down” to one place or do you want the flexibility of renting that allows you to move quickly and (relatively) affordably? Do you want the responsibility of caring for and being in charge of a home?

- Are you planning to buy with another person or more than one person? If so, who are you buying with? A family member? Friend(s)? Romantic partner(s)? A spouse? What kind of relationship do you have with this person or persons? How stable is your relationship with them? How are they with managing and contributing money and finances or non-monetary value to your household? Do you feel safe entering into a long-term financial contract with them?

- What are your future aspirations? Do you see yourself pursuing any major career, life, education, or family/relationship changes in the near future? What are those changes and how do they impact your readiness to buy?

Do You Have the Cash Money?

Traditional financial advice recommends a 20% downpayment on a home. Ha! I literally know no one who has been able to afford that, not in this recession economy! Many folks, including myself, took advantage of a first-time homebuyers program that requires a smaller down payment, as little as 3% down.

There are other immediate costs in addition to the downpayment, including the home inspection, closing costs, any immediate repairs that need to be made, and the mortgage application and appraisal fees. There’s also homeowner’s insurance, private mortgage insurance (which is additional insurance you’ll need if you’re putting less than 20% down), and property taxes to be paid.

You can sometimes get the seller to pay up front for the closing costs. You can also usually ask a seller who is motivated to sell to make necessary repairs to the property before you buy as part of your agreement.

- Do you have or can you get together the cash for a down payment, closing costs, homeowner’s insurance, private mortgage insurance (if applicable), and the other costs of buying a home?

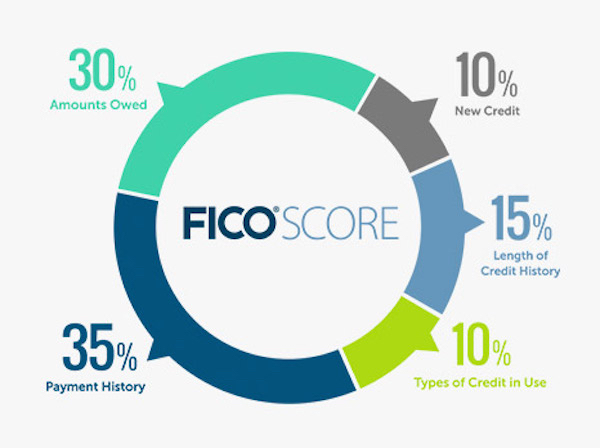

- Is your credit score decent? You’ll need a good credit score or a co-signer with a good credit score to qualify for a loan.

- Is your debt-to-income ratio (including school loans, credit card debt, utility bills, etc.) manageable enough that a mortgage payment would be within your budget? Are you financially prepared to be locked into a long-term financial commitment like a mortgage? A mortgage is a pretty big deal and if you can’t afford to pay, you can really screw up your credit score and literally end up homeless.

- If buying with someone else, what is their financial snapshot like? What can they contribute? What does their credit look like?

Assess Your Personal Values

Finally, sometimes it helps to make a good ol’ pro and con list of renting vs. buying. It will help you assess what your values are around home ownership and whether it really makes sense for you right now.

- What are the reasons you might want to buy? Why might you be better off renting?

- What are your expectations for owning vs. renting?

- If buying with someone else, how stable is that relationship? Do you have the trust in your relationship each other you need to enter into a major legally binding purchase? How will you protect yourself and your assets if the relationship ends for any reason (break-up, divorce, moving, death)?

Getting Your Financial Shit Together

via Shutterstock

Assess your financial plan before you even begin looking at houses. You don’t want to do it in the reverse, which could result in you being seduced into buying a home or entering a financial agreement that isn’t a good fit or, worse, could bankrupt you. There may be a nonprofit or housing program that offers first-time homebuyer classes in your neighborhood, which can be a good place to start learning about the costs of homebuying near you, as well as hook you up with local resources.

How Much House Can You Afford?

There are two ways to approach this question: 1) How much mortgage can you get preapproved for from a bank? and 2) How much can you reasonably afford to allocate to a mortgage payment in your household budget?

You may be able to get a bank to preapprove you for $300k, but that doesn’t mean you should necessarily go out and buy a $300k house. What other expenses do you have that impact your budget? Do you have education loans? Credit card debt? Medical debt? What are your transportation, phone, and grocery costs? Do you have children or dependents? Pets?

Inclusive of all your expenses and income, what can you actually afford to spend on your home? Figure out this number before you even apply to get pre-approved for a mortgage, so you know what is actually reasonable and you’re not tempted to buy above what you can afford.

Check Your Credit Score

Get a free copy of your credit score and report. Many credit card companies offer this service for free. You can also access your report for free at MyBankrate or at the federal free credit report site. Credit scores are between 300-800; the higher, the better. Check your report for errors. If your score is low, you may have a hard time getting a mortgage loan and you may want to work on building your credit before you pursue home ownership.

Get Pre-Approved

Before you start seriously considering homes, you should get pre-approved for a mortgage by a bank or lender. You should get more than one quote and see who is offering you the best APR rates and options. If you’re a member of a credit union or co-operative bank, that can be a great place to start. Your real estate agent may also have suggestions about mortgage professionals. Don’t feel pressured to use your real estate agent’s (or anyone’s) recommendation. Do check out all your options.

I didn’t follow this advice at all because I found our perfect-ish home before I was preapproved and wanted to move quickly, but I would totally recommend it in an ideal situation. Don’t be getting preapproved over the phone while waiting for your flight to board in an airport on a Saturday morning from a lender you’ve never met. It worked out fine for us, but it could have been a major misstep.

Research First-Time Homebuyer Loans, Grants, and Programs