Home Sweet Homo: A Guide to Buying Your First Home

feature image via Shutterstock

There are a whole lotta benefits to renting, like not having to replace your refrigerator when it breaks or being able to pack up and move if your neighbors are awful. My partner and I rented for seven years in various roommate configurations, but after a while, when it was clear we were going to stay in the city we live in, we decided to stop throwing our money into a bottomless pit. We decided we’d like to own a little piece of Planet Earth to call our home.

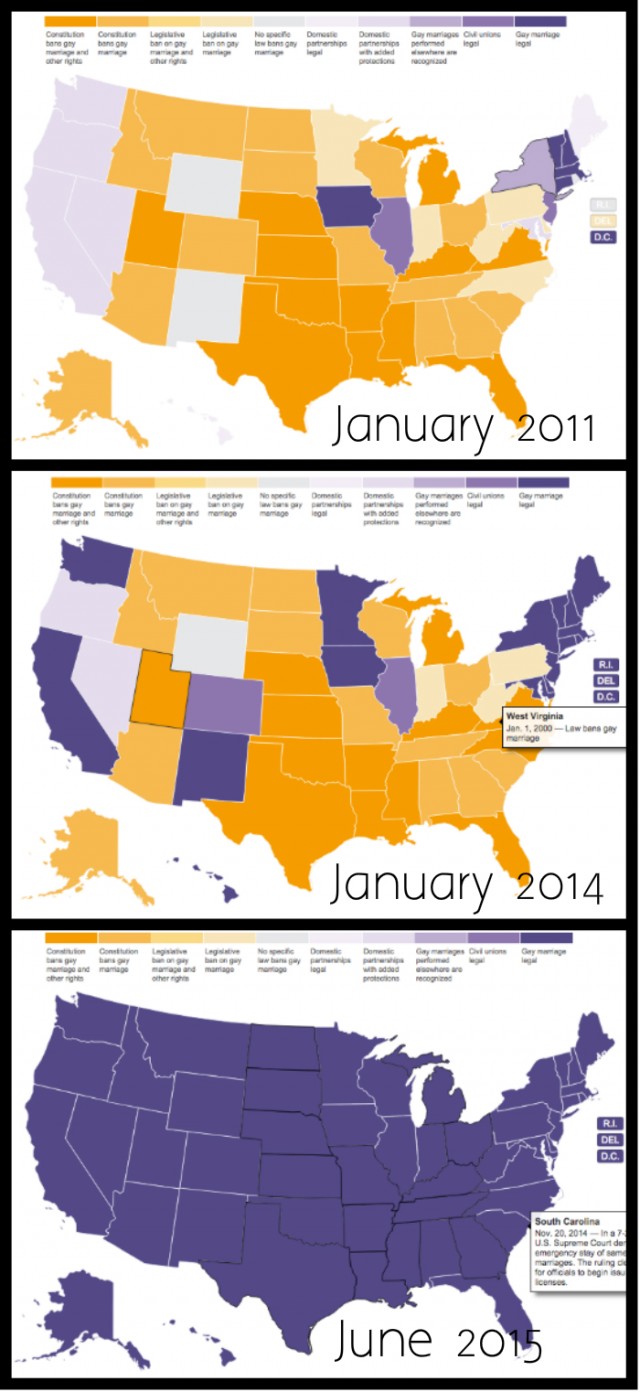

We’re not alone! Since the 2015 SCOTUS ruling in Obergefell v. Hodges, federally recognized marriage equality means that married LGBT couples have access to the same protections that heterosexual couples enjoy when purchasing property together or raising children together. According to a recent survey of their 1500 members, the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP) found that 47% of their members believe more LGBT married couples are buying homes than prior to the federal marriage equality decision.

Marriage equality map over time from the L.A. Times chronology map

It can feel like a big thing, buying your first home. There’s a lot of money and planning and legal stuff involved and lots and lots and lots of paperwork.

Like most things in “grown-up” life, home-buying decisions for LGBTQIA people comes with unique considerations and challenges.

For example, depending on where you live and what your community is like, you may or may not be able to find an LGBTQ real estate agent. You may not even be able to find an openly LGBTQ-friendly real estate agent. Your agent may or may not know which neighborhoods are queer-friendly or may have misconceptions about what that even means and drop you into the affluent gay white neighborhood when you’d rather be in a different part of your city/town/county/whatever-kind-of-municipality-you’re-buying-in.

If you’re buying with a partner or partners, it’s imperative that your attorney knows what the laws are and what kinds of tenancy agreements are available to you that best protect your family. That’s on top of the stress of budgeting for, finding, getting approved to buy, putting an offer in on, and managing a timely closing on a home. Welp.

As a home-owning queer person, I’m here to help!

Deciding You’re Ready to Buy

via Shutterstock

What Is Your Life?

Before you commit to buying a home, you need to honestly assess where you are in your life. Buying a house is a huge commitment and it may or may not be a good fit for you right now.

- Do you feel certain you want to live in the same place for at least five years? If not, what would you do with your home if you decide to move in the near future? Are you open to renting it and being a landlord if you move? Could you sell it and recoup your costs quickly?

- Do you like the idea of being “tied down” to one place or do you want the flexibility of renting that allows you to move quickly and (relatively) affordably? Do you want the responsibility of caring for and being in charge of a home?

- Are you planning to buy with another person or more than one person? If so, who are you buying with? A family member? Friend(s)? Romantic partner(s)? A spouse? What kind of relationship do you have with this person or persons? How stable is your relationship with them? How are they with managing and contributing money and finances or non-monetary value to your household? Do you feel safe entering into a long-term financial contract with them?

- What are your future aspirations? Do you see yourself pursuing any major career, life, education, or family/relationship changes in the near future? What are those changes and how do they impact your readiness to buy?

Do You Have the Cash Money?

Traditional financial advice recommends a 20% downpayment on a home. Ha! I literally know no one who has been able to afford that, not in this recession economy! Many folks, including myself, took advantage of a first-time homebuyers program that requires a smaller down payment, as little as 3% down.

There are other immediate costs in addition to the downpayment, including the home inspection, closing costs, any immediate repairs that need to be made, and the mortgage application and appraisal fees. There’s also homeowner’s insurance, private mortgage insurance (which is additional insurance you’ll need if you’re putting less than 20% down), and property taxes to be paid.

You can sometimes get the seller to pay up front for the closing costs. You can also usually ask a seller who is motivated to sell to make necessary repairs to the property before you buy as part of your agreement.

- Do you have or can you get together the cash for a down payment, closing costs, homeowner’s insurance, private mortgage insurance (if applicable), and the other costs of buying a home?

- Is your credit score decent? You’ll need a good credit score or a co-signer with a good credit score to qualify for a loan.

- Is your debt-to-income ratio (including school loans, credit card debt, utility bills, etc.) manageable enough that a mortgage payment would be within your budget? Are you financially prepared to be locked into a long-term financial commitment like a mortgage? A mortgage is a pretty big deal and if you can’t afford to pay, you can really screw up your credit score and literally end up homeless.

- If buying with someone else, what is their financial snapshot like? What can they contribute? What does their credit look like?

Assess Your Personal Values

Finally, sometimes it helps to make a good ol’ pro and con list of renting vs. buying. It will help you assess what your values are around home ownership and whether it really makes sense for you right now.

- What are the reasons you might want to buy? Why might you be better off renting?

- What are your expectations for owning vs. renting?

- If buying with someone else, how stable is that relationship? Do you have the trust in your relationship each other you need to enter into a major legally binding purchase? How will you protect yourself and your assets if the relationship ends for any reason (break-up, divorce, moving, death)?

Getting Your Financial Shit Together

via Shutterstock

Assess your financial plan before you even begin looking at houses. You don’t want to do it in the reverse, which could result in you being seduced into buying a home or entering a financial agreement that isn’t a good fit or, worse, could bankrupt you. There may be a nonprofit or housing program that offers first-time homebuyer classes in your neighborhood, which can be a good place to start learning about the costs of homebuying near you, as well as hook you up with local resources.

How Much House Can You Afford?

There are two ways to approach this question: 1) How much mortgage can you get preapproved for from a bank? and 2) How much can you reasonably afford to allocate to a mortgage payment in your household budget?

You may be able to get a bank to preapprove you for $300k, but that doesn’t mean you should necessarily go out and buy a $300k house. What other expenses do you have that impact your budget? Do you have education loans? Credit card debt? Medical debt? What are your transportation, phone, and grocery costs? Do you have children or dependents? Pets?

Inclusive of all your expenses and income, what can you actually afford to spend on your home? Figure out this number before you even apply to get pre-approved for a mortgage, so you know what is actually reasonable and you’re not tempted to buy above what you can afford.

Check Your Credit Score

Get a free copy of your credit score and report. Many credit card companies offer this service for free. You can also access your report for free at MyBankrate or at the federal free credit report site. Credit scores are between 300-800; the higher, the better. Check your report for errors. If your score is low, you may have a hard time getting a mortgage loan and you may want to work on building your credit before you pursue home ownership.

Get Pre-Approved

Before you start seriously considering homes, you should get pre-approved for a mortgage by a bank or lender. You should get more than one quote and see who is offering you the best APR rates and options. If you’re a member of a credit union or co-operative bank, that can be a great place to start. Your real estate agent may also have suggestions about mortgage professionals. Don’t feel pressured to use your real estate agent’s (or anyone’s) recommendation. Do check out all your options.

I didn’t follow this advice at all because I found our perfect-ish home before I was preapproved and wanted to move quickly, but I would totally recommend it in an ideal situation. Don’t be getting preapproved over the phone while waiting for your flight to board in an airport on a Saturday morning from a lender you’ve never met. It worked out fine for us, but it could have been a major misstep.

Research First-Time Homebuyer Loans, Grants, and Programs

There are a bunch of federal, state, and local programs to assist homebuyers. See what’s available where you live. Read up on federal programs and state programs you might benefit from or qualify for.

Finding Your Dream-ish Perfect-ish Home

via Shutterstock

Unless you’re buying bare land and building your dream home from the foundation up, you’re probably not going to find a house with picture windows and a Jacuzzi tub and an open floor plan and a giant slide from the attic to the basement.

Make a Dream List

Sit down and write down (literally, write it down) a list of your:

- Must haves

- Wanna haves

- No ways!

Think about things like location, green space, storage space, the number of bedrooms and bathrooms, square footage, type of floor plan, accessibility, parking and/or transportation, your commute to school or work, the type of heat and energy, and whether you want a fixer-upper or a move-in ready home.

Dream big! Then, decide what you really, really need and what you can live without or buy/add/fix later on. Don’t fret too much about the color of the paint or wallpaper, the ceiling material, the lack of landscaping, or other things that you can probably alter over time relatively inexpensively.

Even though I know those shows are fake, every time I see a Househunters where someone refuses a place because of the wall color or popcorn ceilings, I want to shake them vigorously.

It’s good to know what you want, but don’t let your dream list prevent you from finding the right home. If you’re buying with a partner or partners or roommates, you may find you have very different dream lists.

The Internet is Your Friend

There are so many listings online. Zillow and Trulia are two popular websites to look at homes for sale and to compare homes by location. They both also show home values for homes that are off the market (not for sale) so you can compare the listing price of a home to other homes in the area. You can also see what the home last sold for and how it has appreciated or depreciated in value over time at both sites.

There’s no reason not to start looking online right now and start to get a sense of what kind of houses interest you. It could help you build your dream list!

Get in the Door at an Open House

Another low-commitment way to start looking at houses is to attend open houses, usually hosted by realtors looking to sell a property quickly. Open houses are advertised in the classified ads of your local papers, online on realtor sites, and through word of mouth.

You typically have free access to the home. The owner isn’t there while the open house is happening, so you can feel free to open closets and cabinets, explore the basement and backyard, test the water pressure, etc.

The realtor will be there and may pressure you to state your interest, so keep that in mind. It’s best to talk about the house later, not in front of the realtor, especially if you might actually be interested. Remember you will be negotiating with the seller, so expressing interest to a seller’s realtor might encourage them to be firm on the asking price. Ask questions, but leave the freaking out over the original hardwood floors for after the walk through.

Hire a Damn Agent

Yes, you can buy or sell a house without a real estate agent, but you know what you probably don’t know a lot about? REAL ESTATE. Real estate practices and law differ from state to state. Buying a home is a huge project to manage on your own. Most buyer’s realtors are paid through the sale of your house on commission, so you’re not paying them directly. (If you’re selling a house, your seller’s agent will take a cut of your profit, just FYI). When you’re ready to start looking at houses seriously, ask around for recommendations of an LGBT-friendly agent.

Once you’ve found someone, you’ll meet with them to share what your budget is, what neighborhoods you’re looking in, and what you want in a house. They’ll provide some advice, including if your expectations are reasonable. They’ll search listings for you and make recommendations of homes to see. You can also ask them to book showings of any houses you find online or through listings that you’re interested in. If you decide to put an offer on a house, your agent will work directly with the seller’s agent and hustle to make sure you close on time by advising you through the process. They are usually also able to recommend an attorney, which you will want and need to draw up the legal paperwork.

Go On the Hunt

Start looking at lots of homes, so many homes, more homes than you think anyone should look at! It can be overwhelming, so you may want to take pictures or video of each and keep a notebook with notes on all the houses you see. If you want to be really extra, you can create a scoring rubric. Consider whether the properties meet your dream list needs and definitely take into consideration the overall structure of the property.

- Run the water in the sinks to test the water pressure and water heater. Flush the toilets to see what the pressure is like.

- Open windows and doors to see if they stick and fit properly.

- Turn light switches on and off to test the electrical system.

- Note the kind of heating (gas, electric, forced air, etc) used, which can drastically impact your utility bill

- Peek at the circuit box and see how many circuits the house has and if there are any free ones

Buying Your Real Adult Home

via Shutterstock

Here’s how it goes down once you’ve found the home you want to claim as your own. Here’s where things get really real. Get ready to move quickly so you close on your house on time, which just means that all the legal and contractual obligations are met within the required time frame. If your closing is delayed and it’s your fault, the seller could renege on your offer and sell to someone else.

Making the Offer

You’ll come up with a number that you are willing to pay, which may be less or more or exactly the same as the asking price. That all depends on your financial circumstances, how in demand the property is, and on how motivated the seller is to get out. Your agent will draw up the offer for you to sign and will communicate the offer to the seller’s agent.

Your offer should be in writing (oral offers don’t hold up in court) and must specify the offer price and all other terms and conditions of the purchase. For example, if the seller agrees to put money towards your closing costs (called a “seller’s concession”) or include $10,000 for roof repair, that should be in writing in the offer. Many offers are contingent on a home inspection, which should be in writing including the time frame during which the home inspection will occur.

An offer will also often include “earnest money,” which is a cash amount that you are offering to make on the house immediately. The earnest money will go towards your escrow and shows that you are serious about buying.

Once you’ve made the offer, the seller can choose to accept or reject it or to reply with a counter offer, which you can accept, reject, or counter back with new terms.

Another thing that can happen is that the another person can put their offer in and you can end up in a “bidding war,” increasing your offer amount until one of you drops out.

Until your offer is accepted by the seller, you aren’t contractually bound to the property and the seller isn’t obligated to sell to you. Once it is accepted in writing, both you and the seller are locked in legally. You’re on your way to owning your home, cupcake!

Inspections, Appraisals, and Mortgage Approvals

Home Inspection

You’ll schedule a home inspection soon after your offer is accepted, usually in the first two weeks or whatever the laws in your area require. The home inspector will send a report to you and the seller. If there are repairs that need to be made, you can request the seller make the repairs before closing. The inspection cost is built into your closing costs or can be paid upfront.

Mortgage Loan

You’re also going to need to prove your income to your mortgage lender, who will go over your bank statements, income, financial history, and credit report with a fine-tooth comb. If you know you’re planning to apply for a mortgage, don’t open new credit or do anything that could impact your credit score. Don’t make a big withdrawal or deposit that can’t easily be accounted for. The interest rate you are offered for your mortgage loan depends on how creditworthy you are.

You can choose to lend from any lender, not just lenders who pre-approved you. You can also choose from different types of mortgages based on your preferences: a 30-year if you want smaller payments or a 15-year if you want to build equity and pay off the loan faster. There’s also a fixed rate if you want to have a reliable never-changing interest rate on your mortgage or a variable rate if you want a lower initial APR and can tolerate some fluctuation in the future based on the market. What you choose may depend on how long you plan to own the house, what your budget is, or what your tolerance for risk in investing is.

You may also choose to buy mortgage points to reduce your interest rate. Mortgage points are an upfront payment in exchange for lower interest rates over the life of the loan. They don’t reduce the amount of the loan itself, though. $125,000 is still $125,000 whether you paid points for a lower interest rate or not.

Home Appraisal

The home appraisal is separate from the home inspection. An appraiser is a third-party entity that inspects the house and reports on the value of the home to both you and the lender. The appraisal is an estimate that tells you whether you’re paying a fair price and tells the lender whether they are making a good investment. If the appraisal is less than the asking price of the home, the lender may be less willing to approve your loan. You are responsible for paying for the appraisal, though the cost is usually worked into your closing costs.

Buy Homeowners Insurance

You’ll need to purchase homeowners insurance. Unlike renting, which usually doesn’t require you to buy renters insurance, you need insurance to own a home. Call or click around and get some quotes. If you have a car or other type of vehicle insurance, you may be able to get a bundle discount on homeowners insurance through the same company. Homeowners insurance will protect you and your valuables in the event of an emergency or severe property damage.

If you are putting less than 20% down, you will also need private mortgage insurance. You can get this through your mortgage lender or a different company or through the Federal Housing Administration. PMI is removed from your payment when you owe less than 20% of the value of the home, per your original loan agreement. Some choose to refinance their mortgage to get out of PMI earlier if their home value increases or they pay off the loan faster than anticipated. At closing, the lender must tell you how long you have to pay PMI for.

Contact a Real Estate Attorney

Your lender or real estate agent can probably recommend a reliable real estate attorney. You’ll have to pay for their services, which can be pricey, but in the long run it’s worth it to know your home purchase is legally sound. Some states require an attorney at closing and others don’t so check laws in your area. A real estate attorney will help draw up paperwork, answer legal questions, ensure the title to the property is in good order, and will be your right-hand gal or guy at your closing. Personally, I’m always afraid of getting ripped off in big financial transactions like this, so having an attorney handle the paperwork made me feel safer.

For unmarried couples or partners or roommates buying together, it’s really important to work with an attorney to ensure all parties’ rights are protected. Ideally, find an attorney who has worked with LGBT buyers before. For example, we bought our home before marriage was legal at the federal level, so even though it was legal in our state, our attorney advised that we both be named on the title and contract. Attorney fees can be included in closing costs.

THE CLOSING

It may feel like the closing date is never going to come — or on the flip side, it could feel like it all happens really fast! Typically, a closing on a home being purchased with a loan will be scheduled 30-45 days after the loan approval. A cash sale might be sooner. A closing date might be later if the buyer has to wait for a lease to end or the seller has to wait for the sale to go through in order to purchase their new home (a contingency sale).

On your closing date, you’ll meet with your attorney (or agent) and sign a billion gazillion papers and pay your closing costs in full. Do some finger stretches. You’re going to be signing for what feels like forever! You’ll pay your closing costs, if you haven’t already, which can include the escrow, title fees, appraisal fees, attorney fees, inspection fees, and mortgage points you may have bought.

Finally, you’ll walk away with the keys to your new home at or shortly after closing! Ready your U-Haul!

Next week, we’re publishing a roundtable of real, live Autostraddle homeowners with some solid, real-talk advice for y’all! Stay tuned for that!

Have questions? Have homebuying and homeowning stories? Plan to rent forever? Share it in the comments!